Gift tax calculator

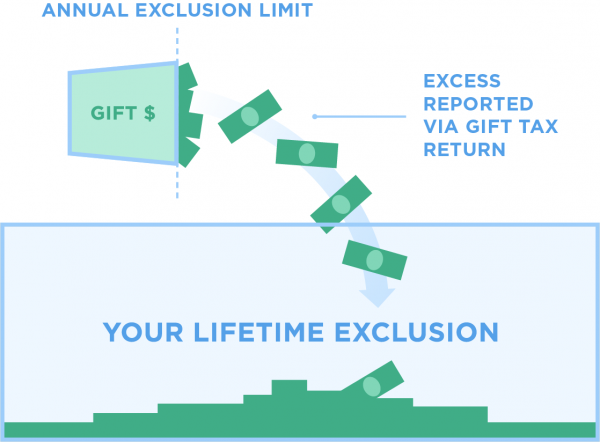

To be tax deductible a donors gift must be covered by what we call a gift type. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

Estate And Gift Tax Exemption Amounts 2019 Rack Law

This exemption is per.

. Gift tax tables. Tax deductible gift types. Inheritance Tax due on the gift is calculated in this way.

This calculator is mainly intended for. Calculate the gift tax based on the total value of the gift. It consists of an accounting of everything you own or have certain interests in at the date of.

How the gift tax is calculated and how the annual gift tax exclusion works. The Inheritance Tax due is 32000. Estate and Gift Taxes.

Select your tax year. This calculator is designed to help you understand some of the key areas of gifting as a starting point to providing specific advice for. In light of these changes the Connecticut Gift Tax Calculator should be used primarily for calculating historical results.

Gift 350000 Minus the Inheritance Tax threshold on 27 March 2021 325000 Amount on which tax can be charged. Calculate deductions tax savings and other benefitsinstantly. This app is an app to calculate the gift tax in Korea.

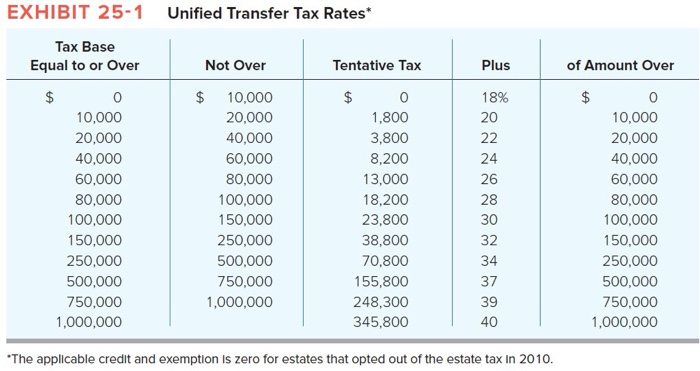

For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. It does not show any amounts that may pass to others using an exclusion or deduction including any additional. For instance if you give someone a gift worth between 20000 and 40000 the marginal gift tax rate is 22.

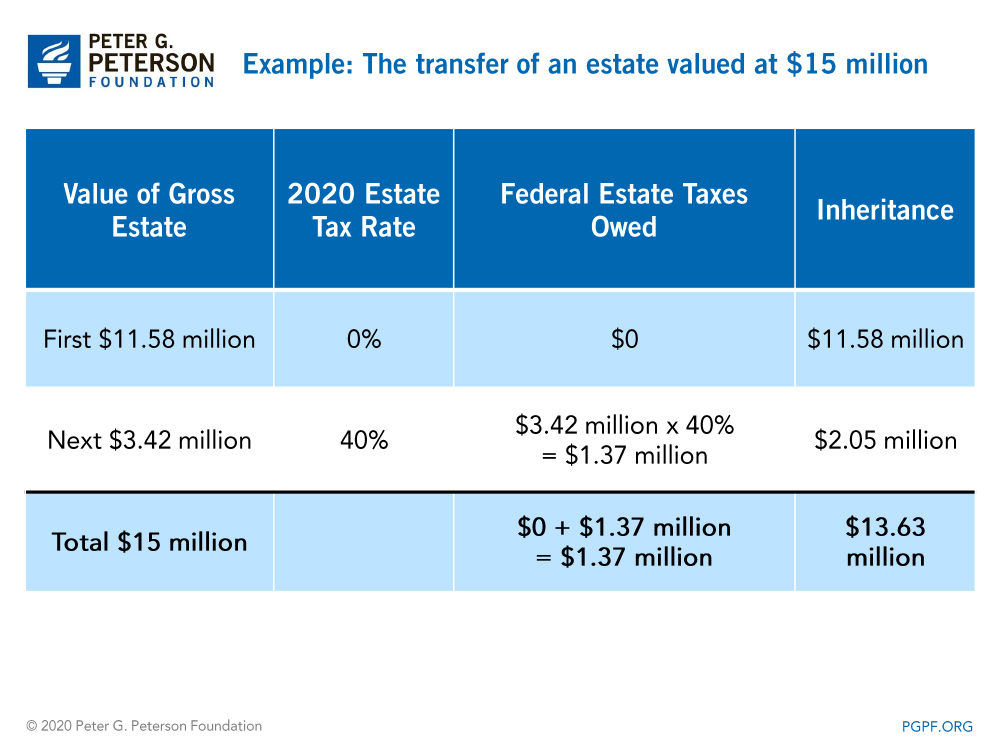

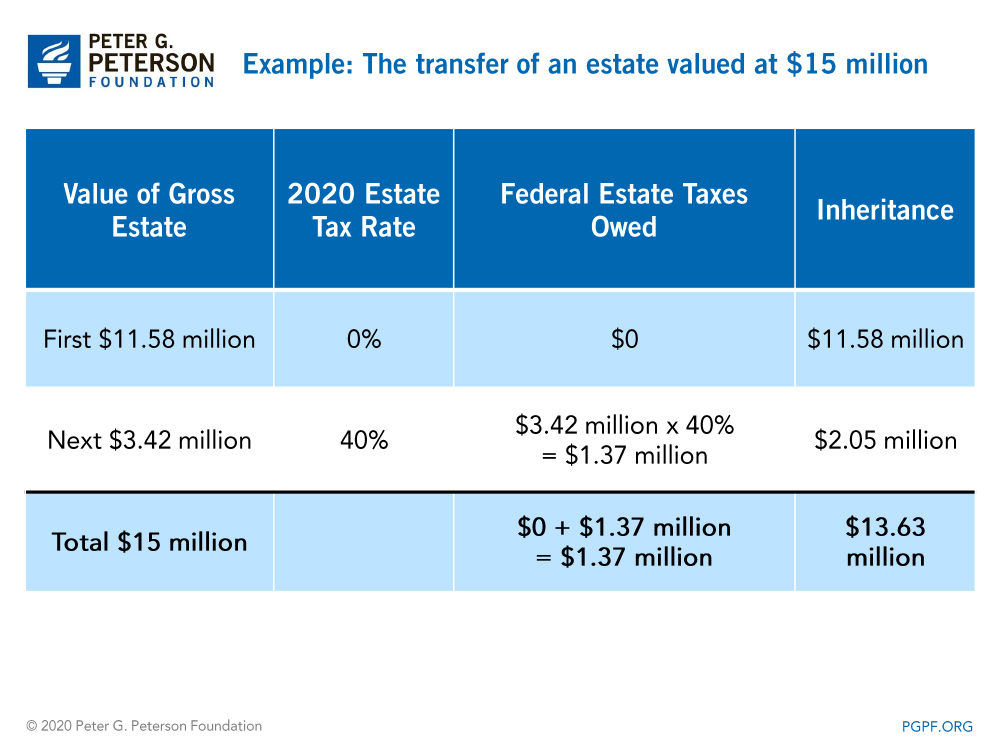

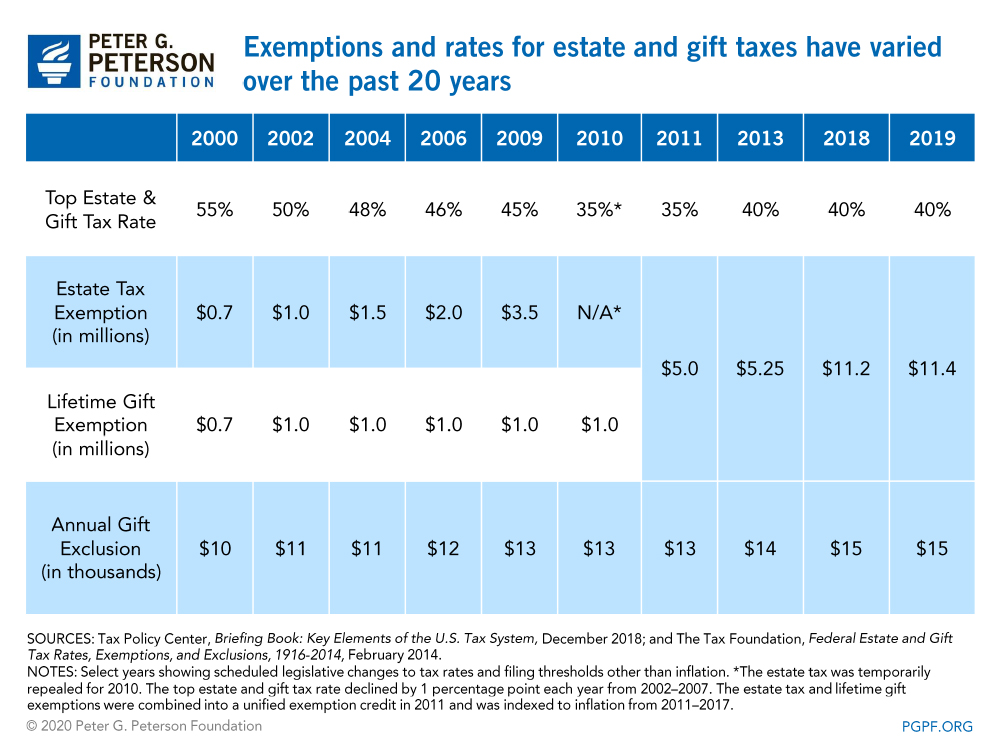

The estate tax is a tax on your right to transfer property at your death. Many states impose their own estate taxes but they tend to be less than the federal estate tax. Choose your filing status from the drop-down list.

This page will be updated as more information becomes. This means that although gifts are free of tax up until the threshold of 5000 you must not deduct. The gift tax rate fluctuates from 18 to 40 percent depending on the size of the gift.

The tax applies whether or not the. Calculate the potential tax benefits associated with gifts of cash andor appreciated assets publicly traded securities closely held stock or real estate during your lifetime. But her friend must pay Inheritance Tax on her 100000 gift at a rate of 32 as its above the tax-free threshold and was given 3 years before Sally died.

The Estate Tax Calculator estimates federal estate tax due. Enter the value of the gifts you have given during the selected tax year. Features - Gift tax calculation - Save result of calculation - Tax Counseling tax.

Gifting is a popular way to reduce inheritance tax liability. If their gift falls into more than one gift type category they can choose the gift type. In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS.

This calculator calculates gift tax based upon the taxable gifts that you input. Use this free no-obligation tool to find the charitable gift thats right for you. How to use the gift tax calculator.

That means you can give up to 1206 million without owing any gift tax. We have applied to the 2016 tax law.

The Gift Tax Rate Schedule Download Table

Clawback Of The Gift Tax

Tom Hruise Was An Entertainment Executive Who Had A Chegg Com

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

Taxation Of Individuals And Business Entities Ppt Download

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

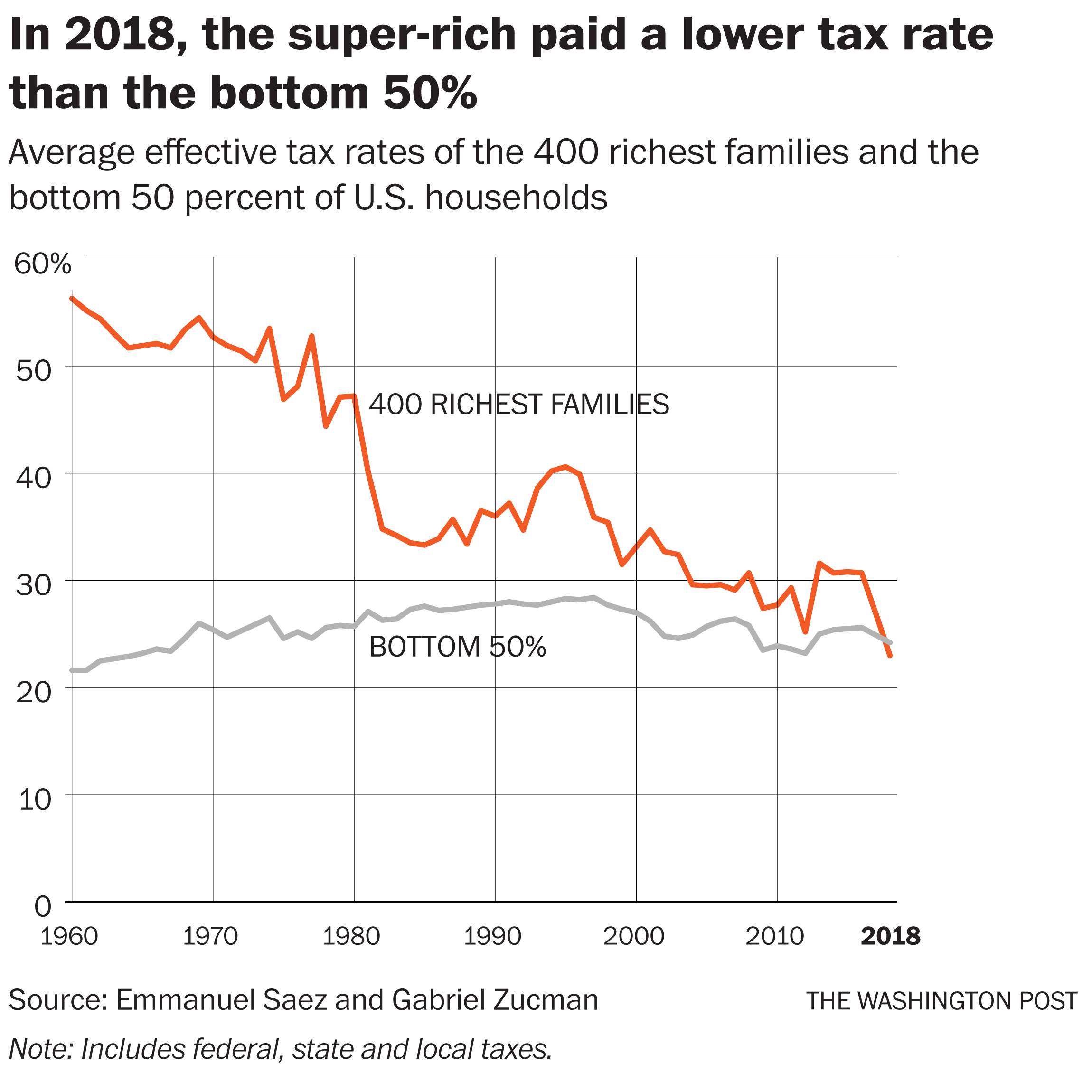

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

Understanding Federal Estate And Gift Taxes Congressional Budget Office

State Corporate Income Tax Rates And Brackets Tax Foundation

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

What Are Estate And Gift Taxes And How Do They Work

2022 Transfer Tax Update

What Are Estate And Gift Taxes And How Do They Work